A provident fund is a compulsory, government-managed retirement savings scheme used in India and other developing countries. An employee has to pay a certain contribution towards the scheme and an equal contribution is paid by the employer. The employee gets a lump sum amount including self and employer’s contribution with interest on both, after leaving the last job or on retirement.

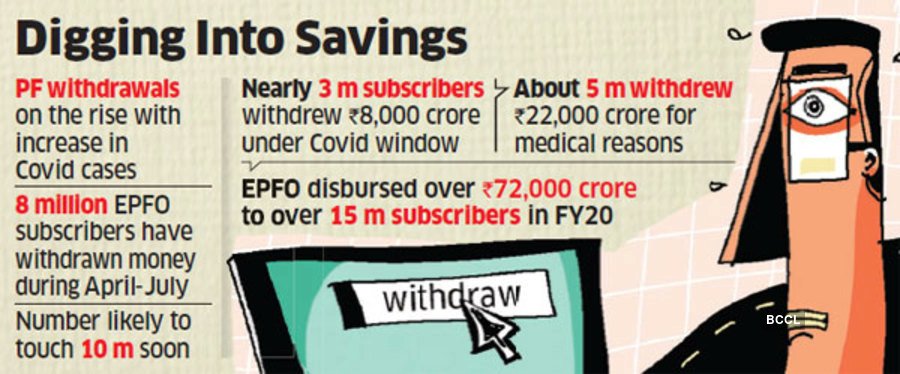

PF withdrawal is considered as the last resort when other means are unavailable. Due to the pandemic, there has been a phenomenal increase in the PF withdrawals. A whopping 8 million subscribers have withdrawn money during this April-July alone. The numbers in the infographic below show some stressful signs.

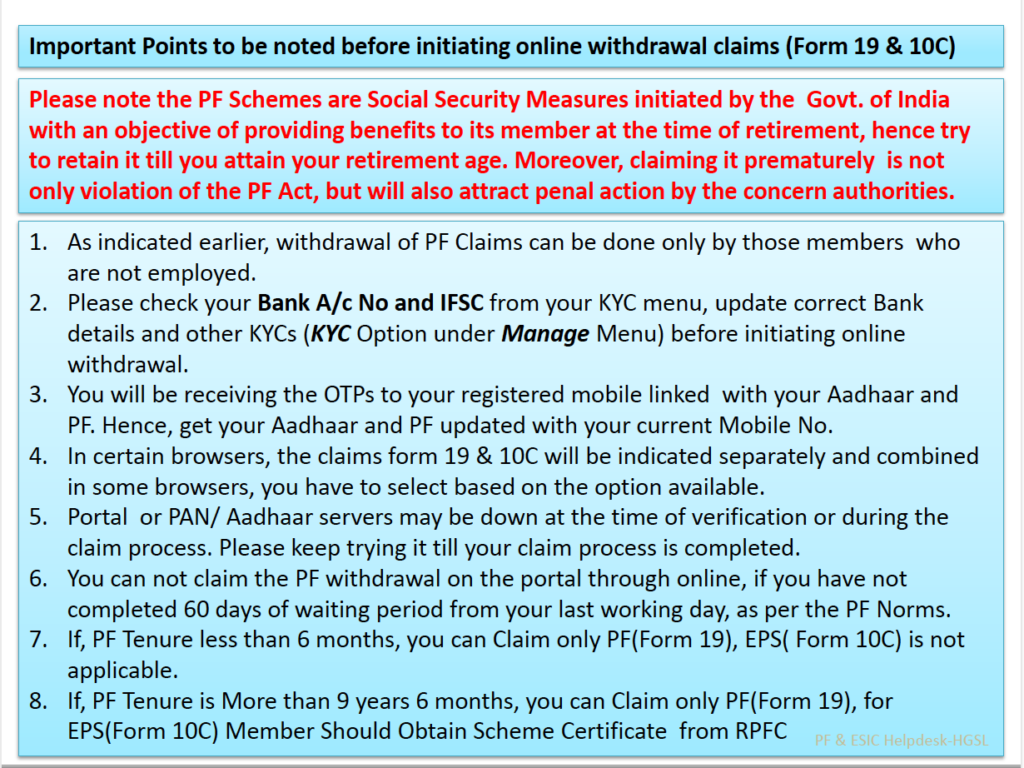

This post explains about PF withdrawal options. To begin with, make sure that your personal details are entered correctly in your PF online account. Personal details mean the name, address, bank details, PAN, and ID proof. PF does not accept bank account with joint holders. Hence, make sure that the bank account is in a single name i.e. PF member.

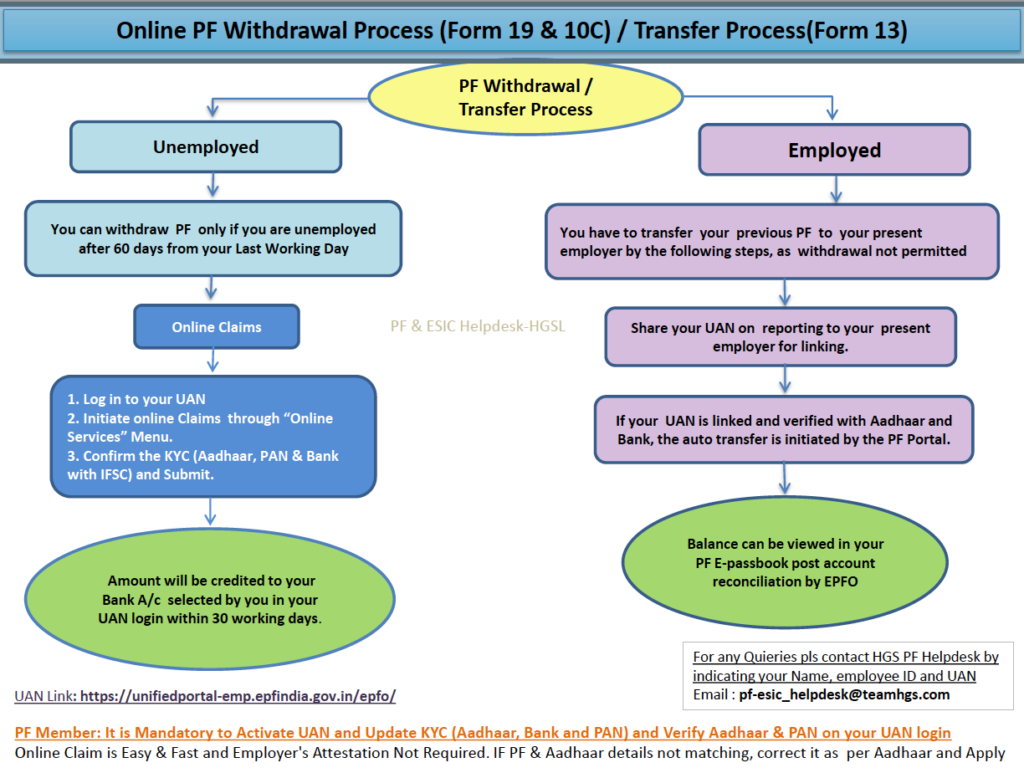

Let us understand the flowchart: How it works?

You can apply for an online withdrawal if you have linked and approved your Aadhaar card. In case, you do not have an Aadhaar card and linked it with alternate ID proof, then you will have to manually submit an application for withdrawal at your local Employee Provident Fund Office. The online process can take up to 1 week, whereas the offline process can take more than 2 weeks.

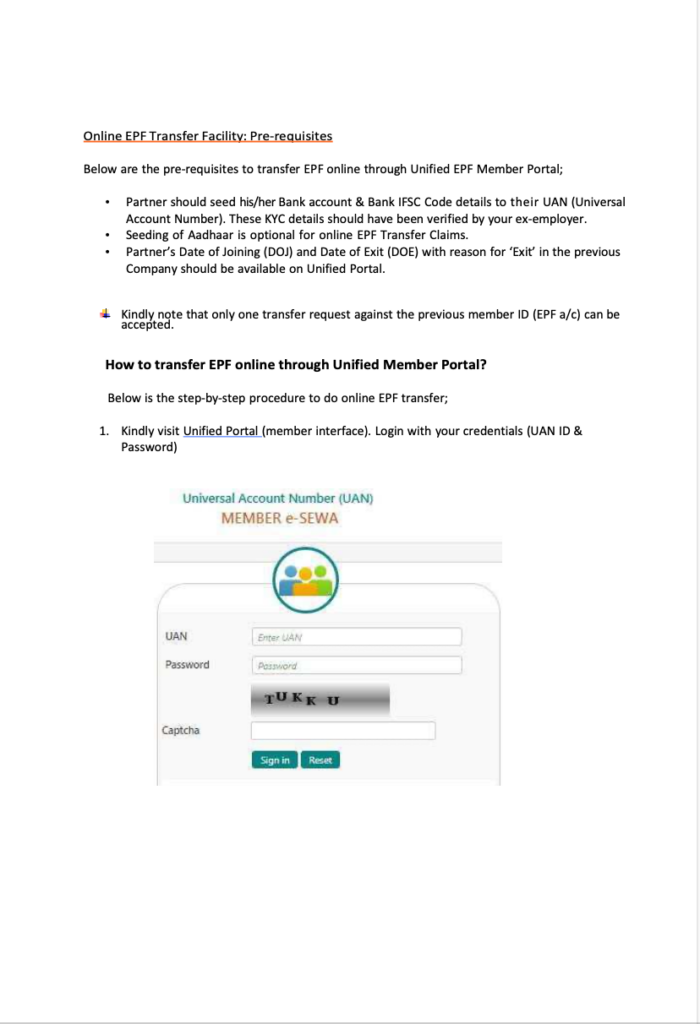

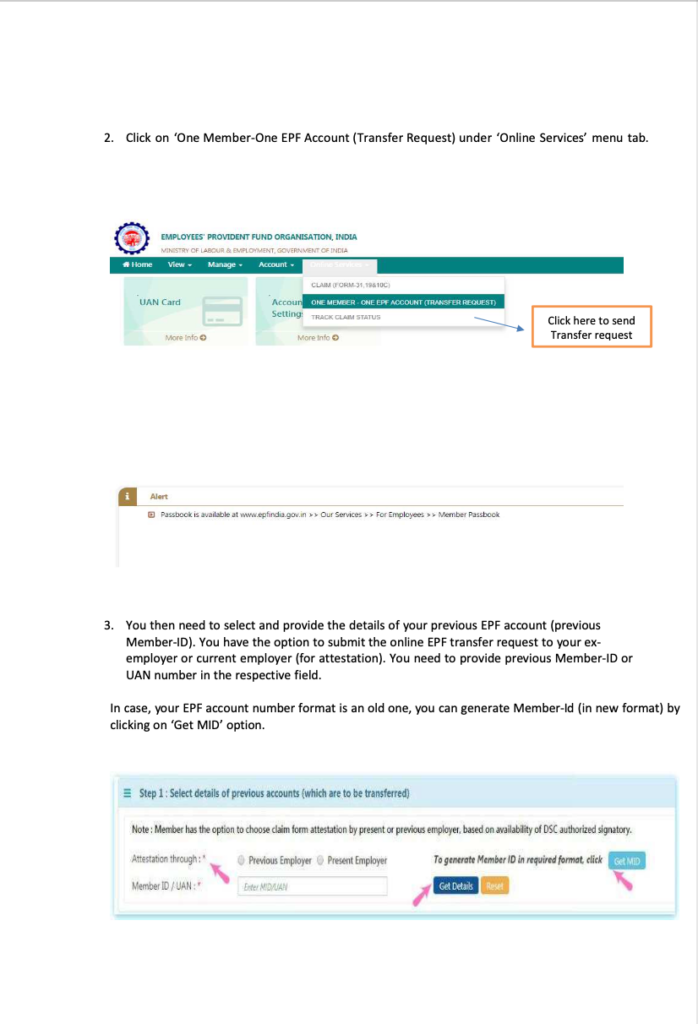

If you have been with 1 or more companies in the past and if you have not sought withdrawal before, then you will have to transfer the accumulated amount from your old company account/s to your last company account.

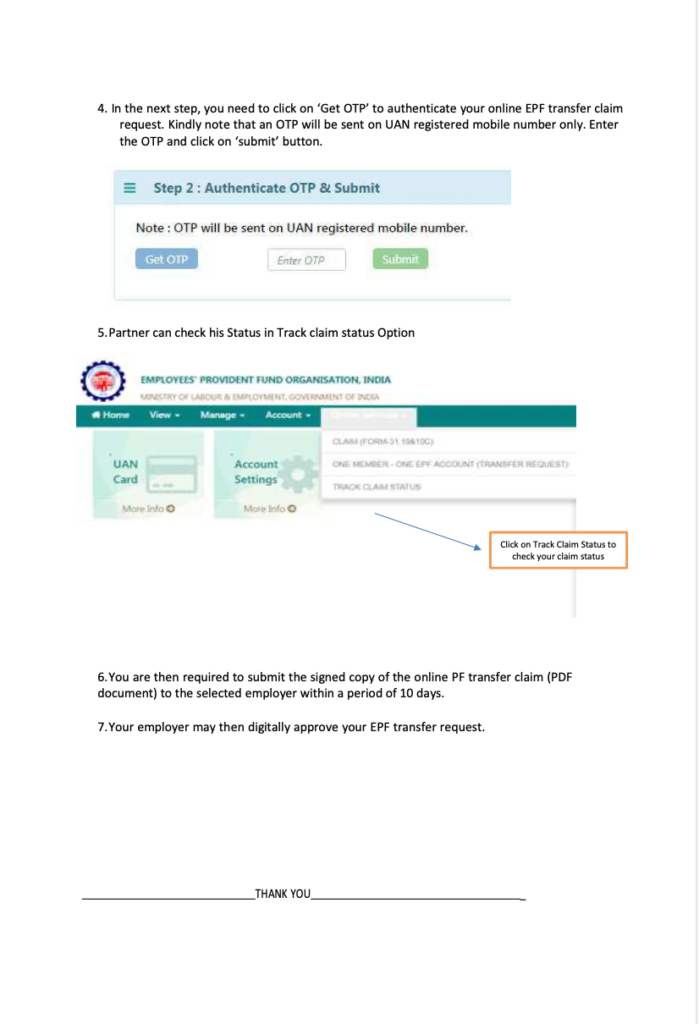

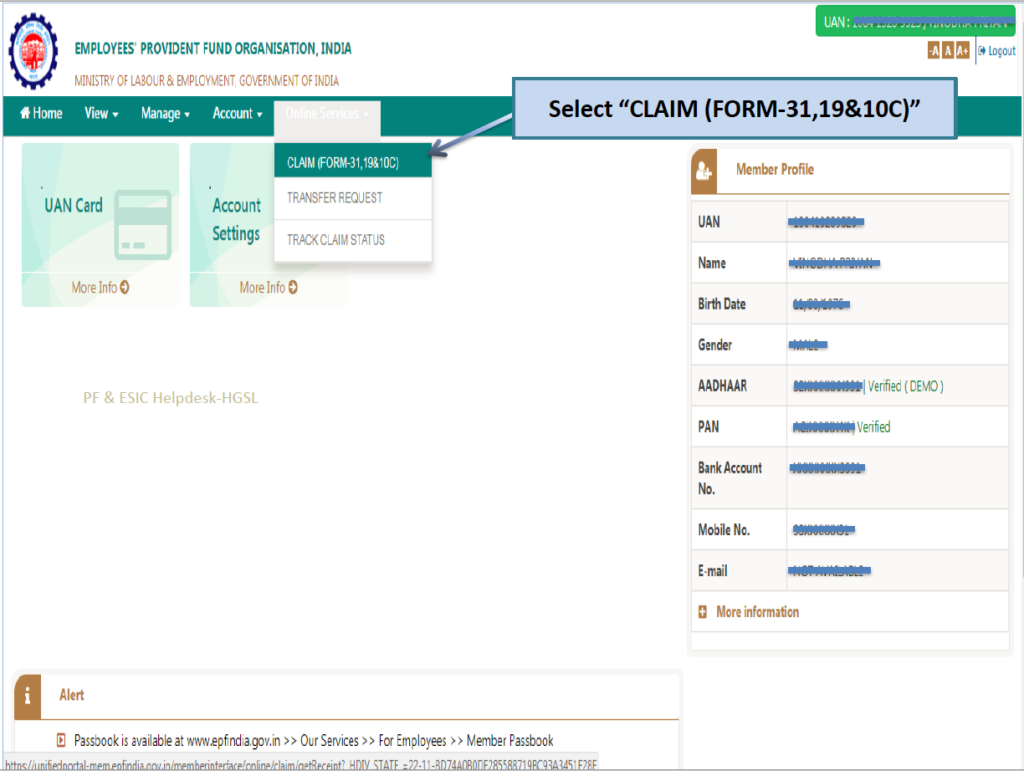

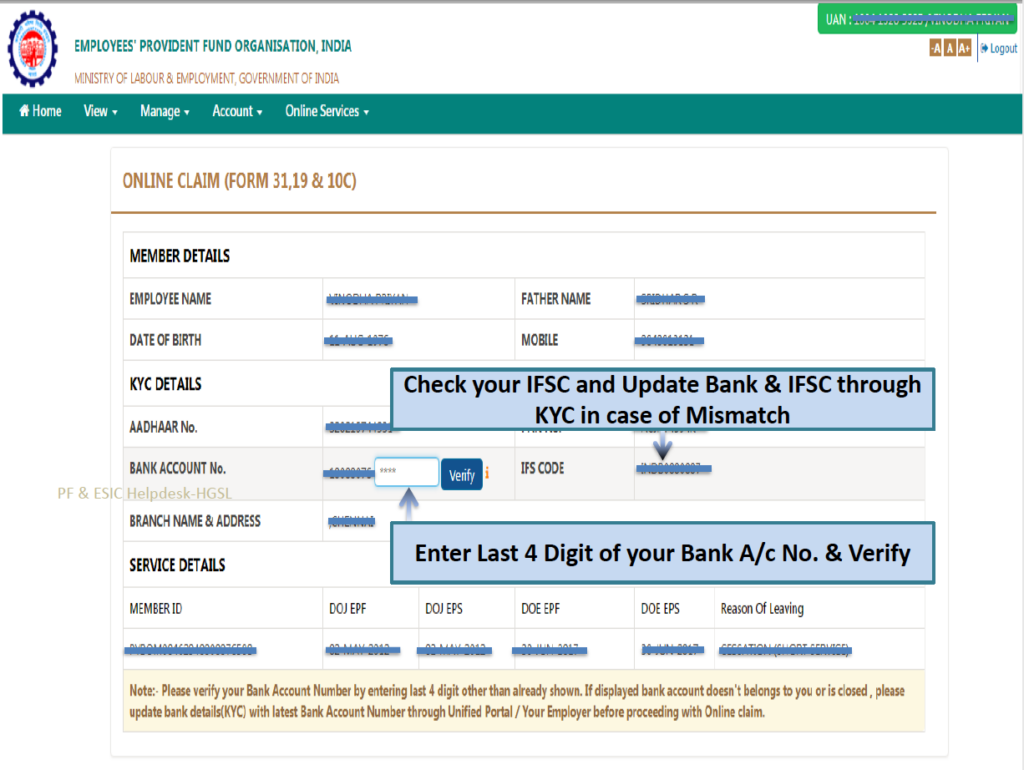

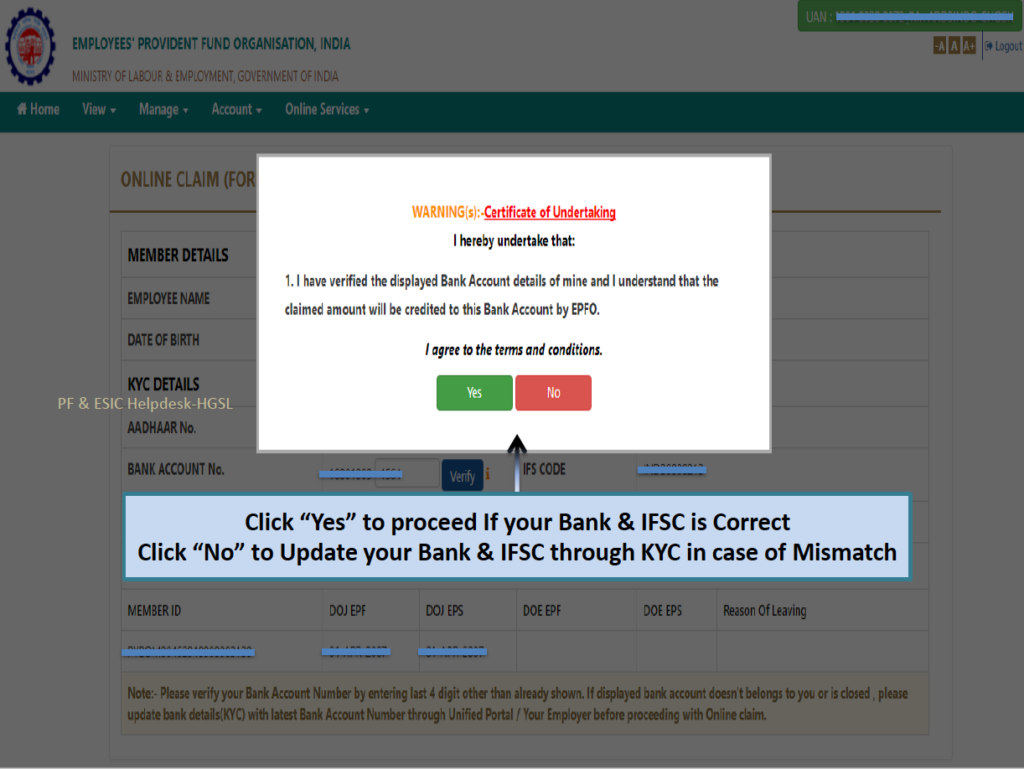

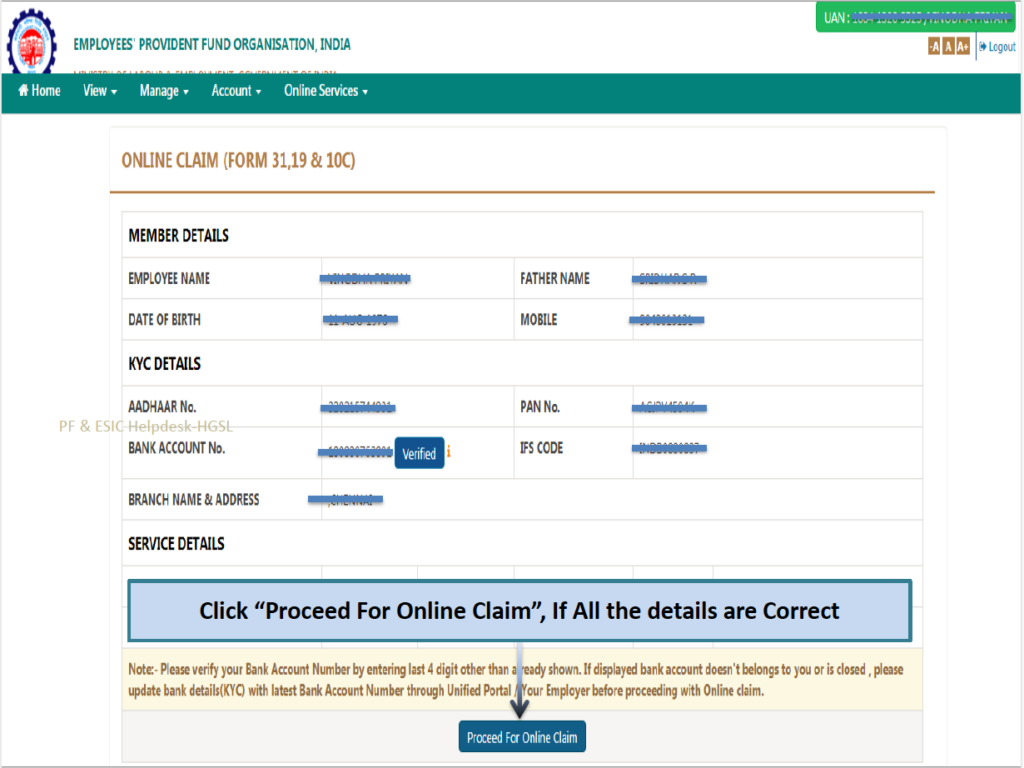

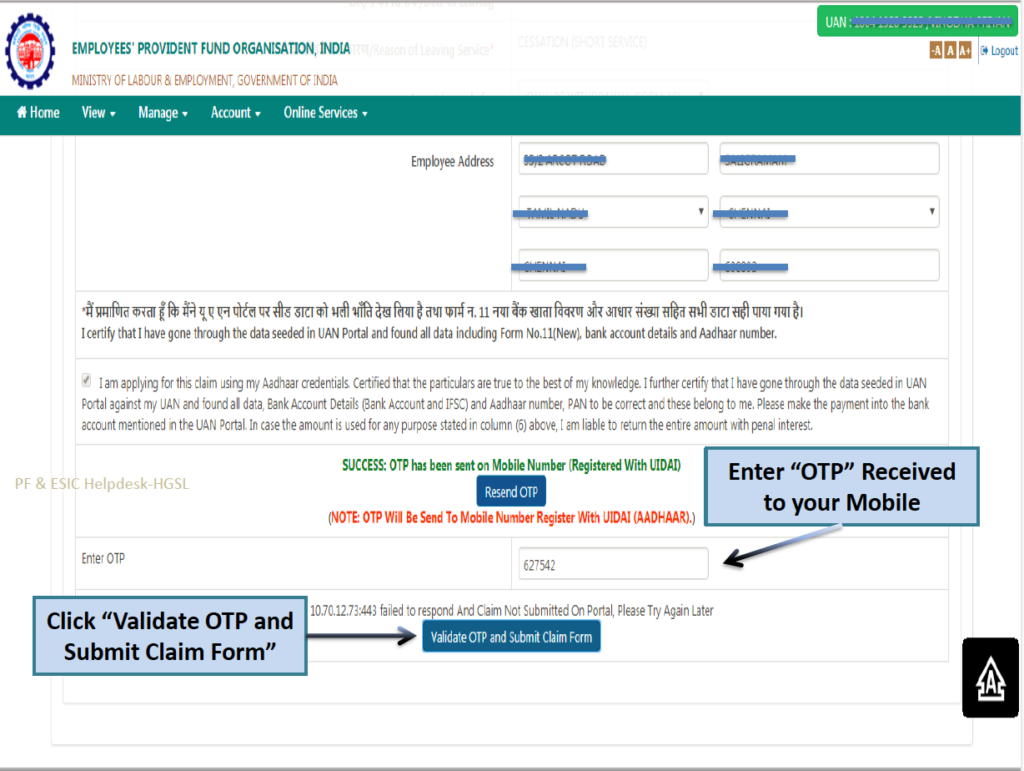

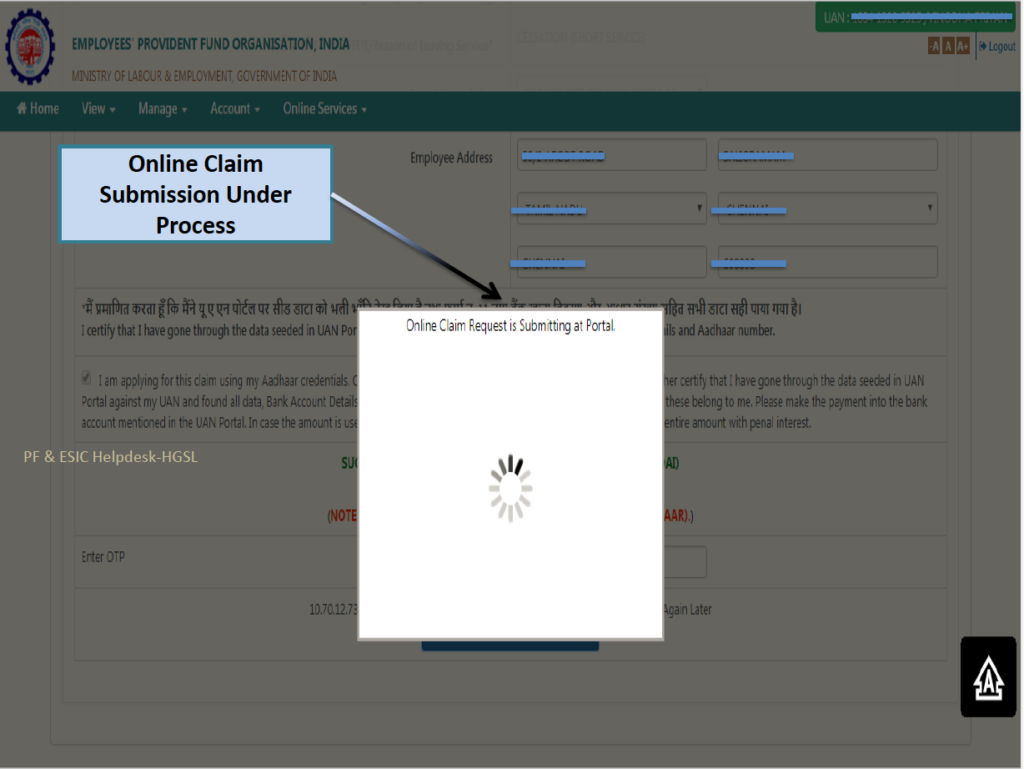

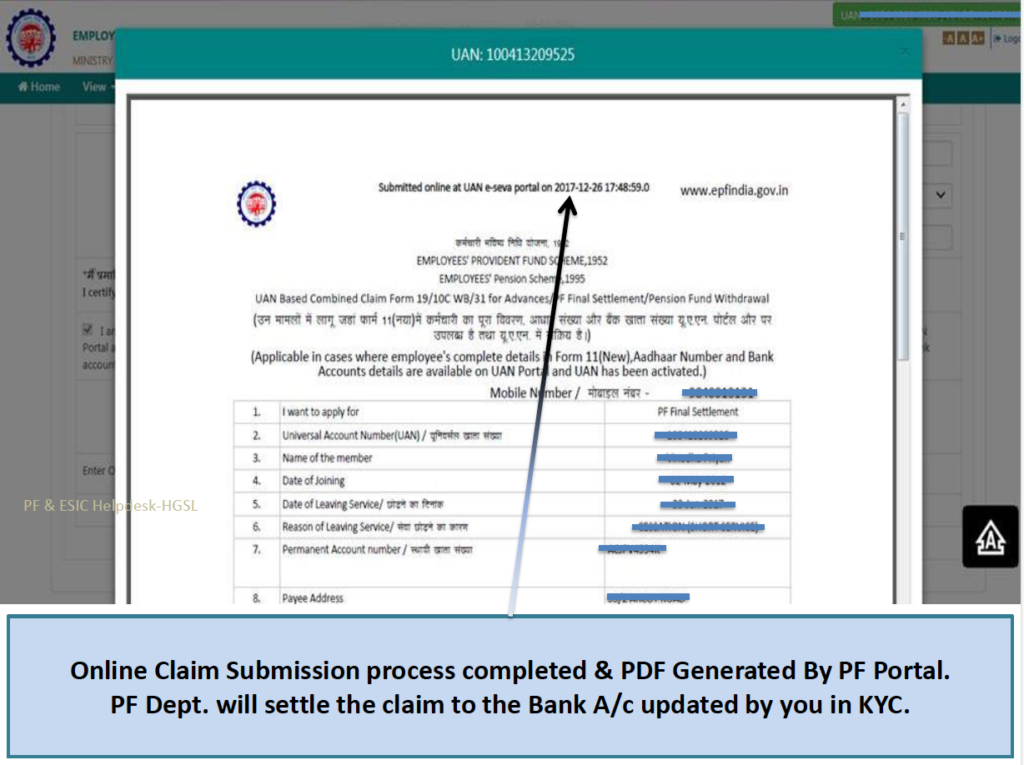

Follow the steps:

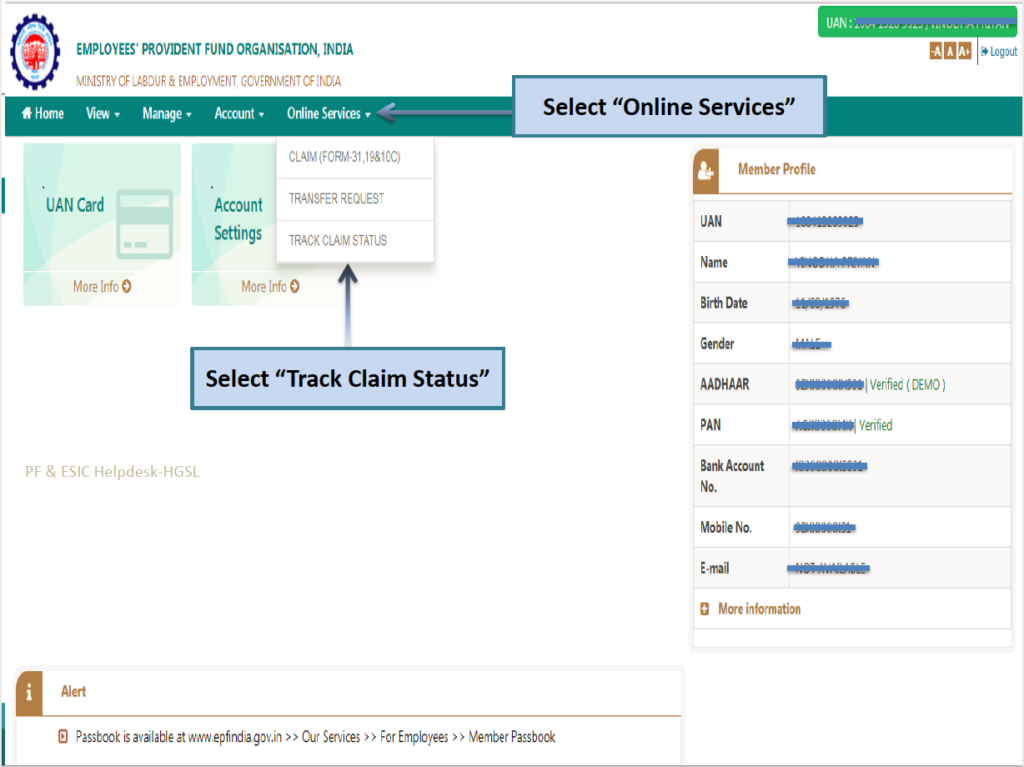

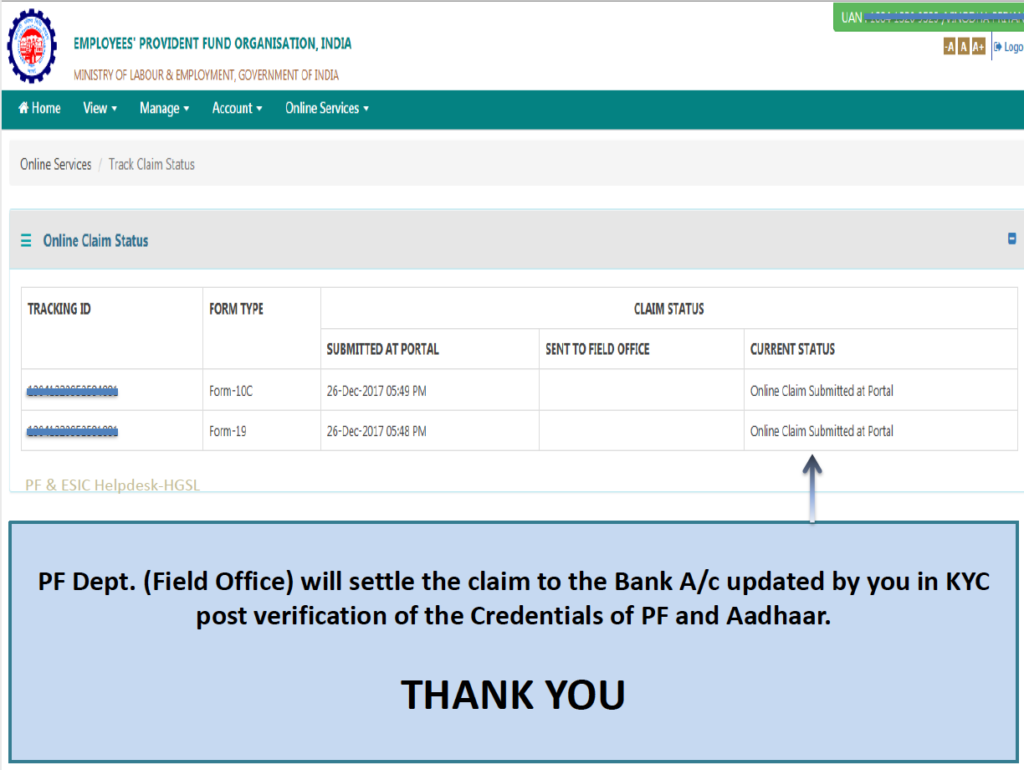

Track your claim status after submitting.

Once your PF has been transferred to your last company account, you can initiate the withdrawal process. Prior to it, again check if your details are in place and KYC done.

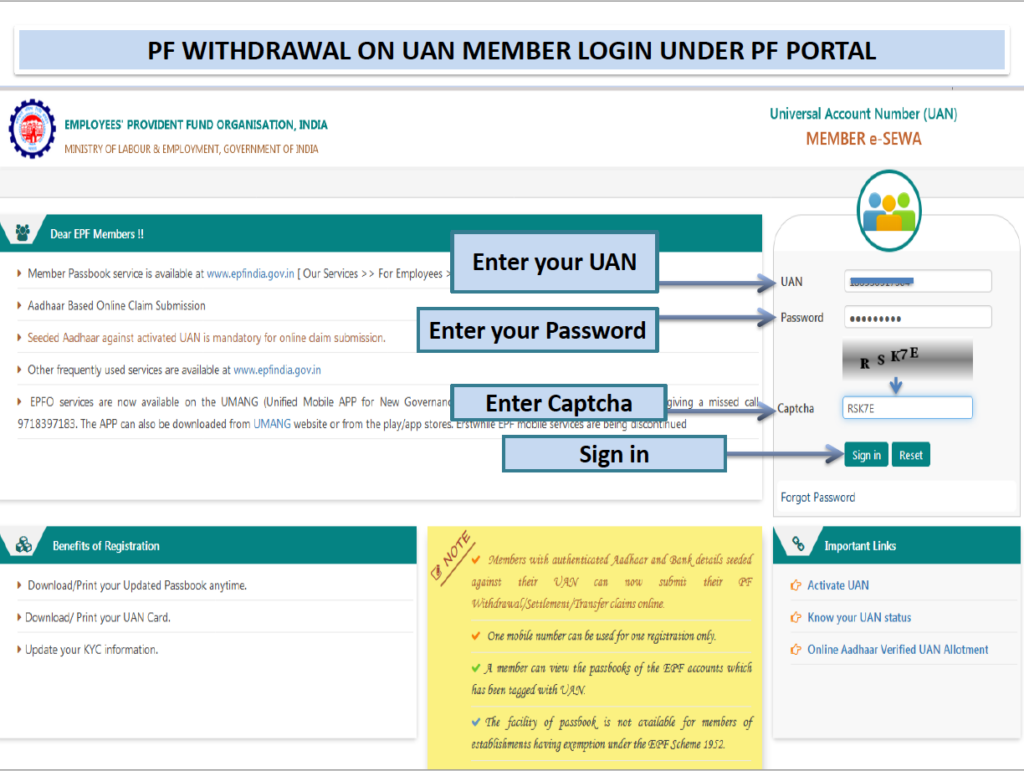

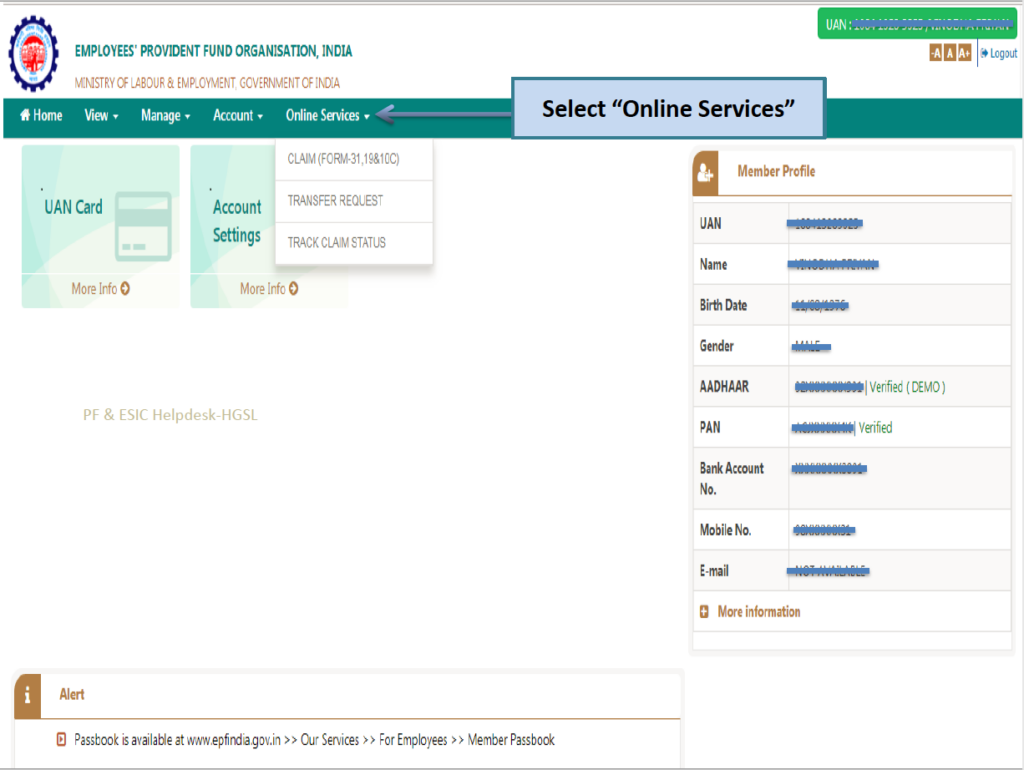

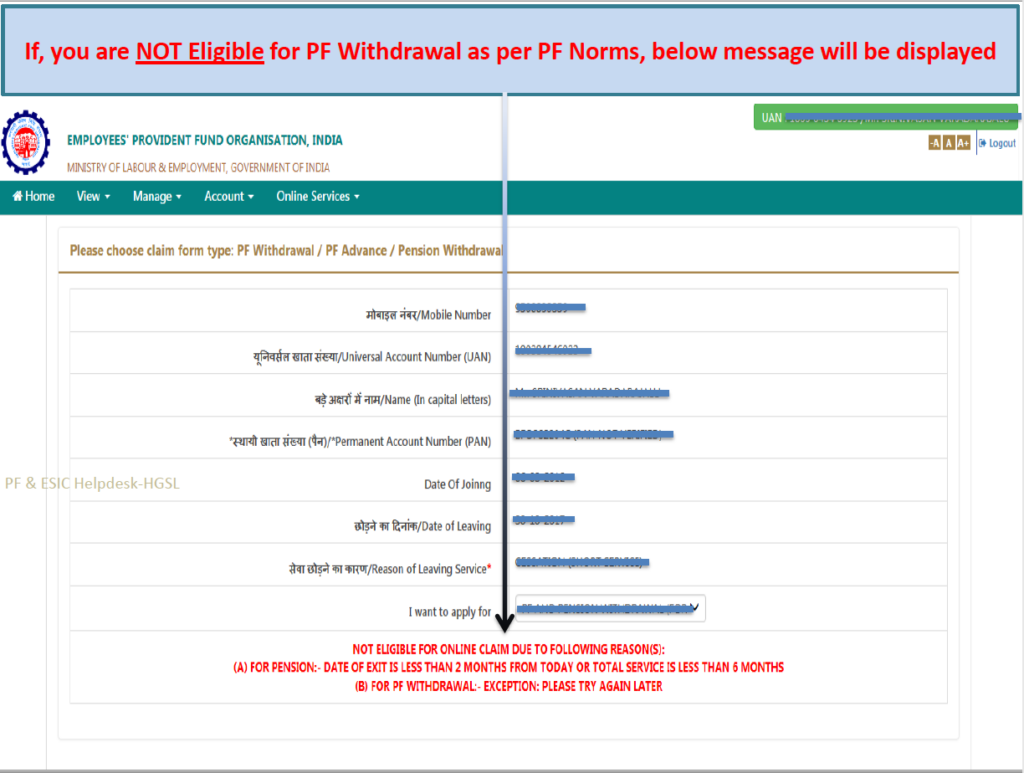

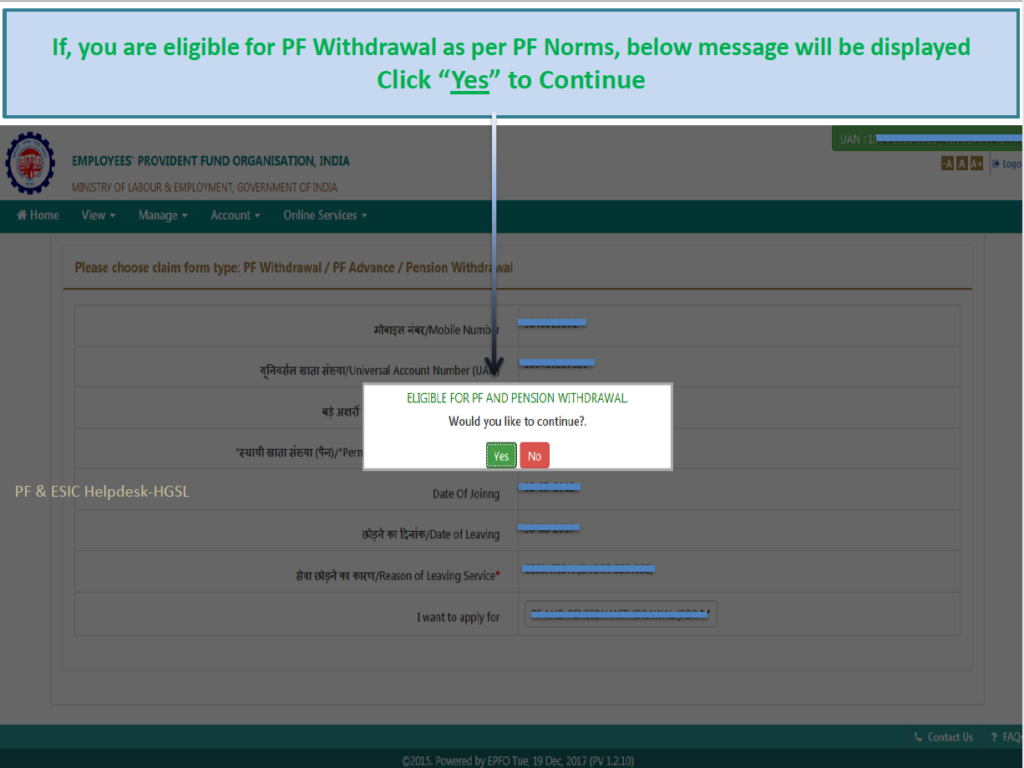

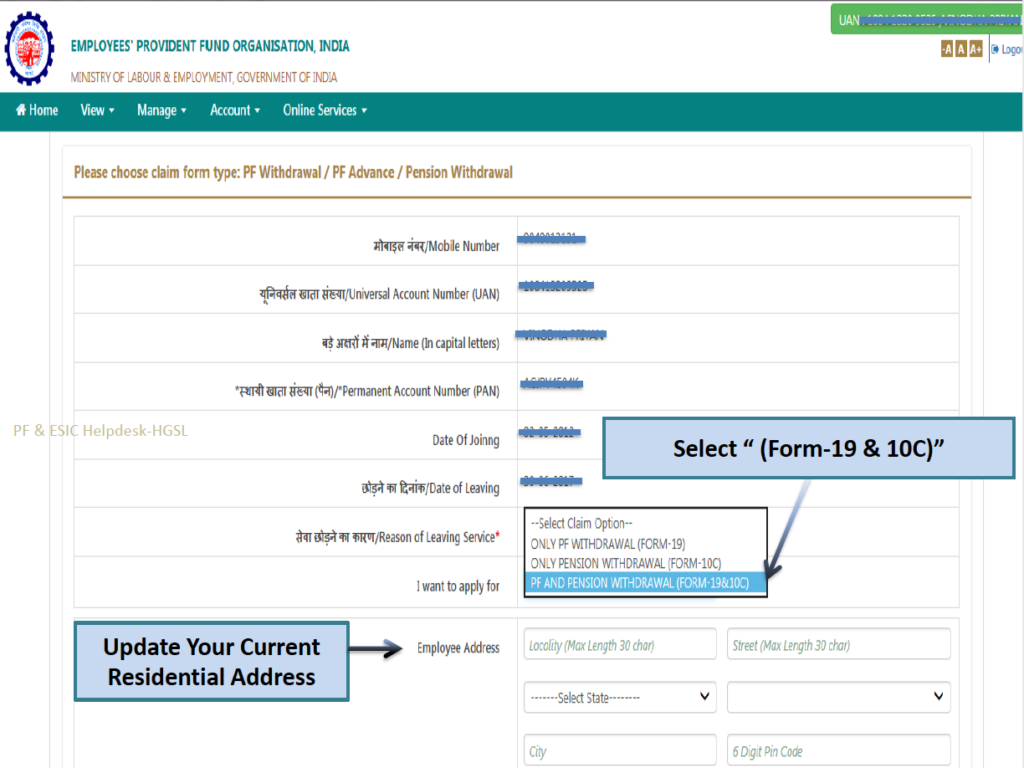

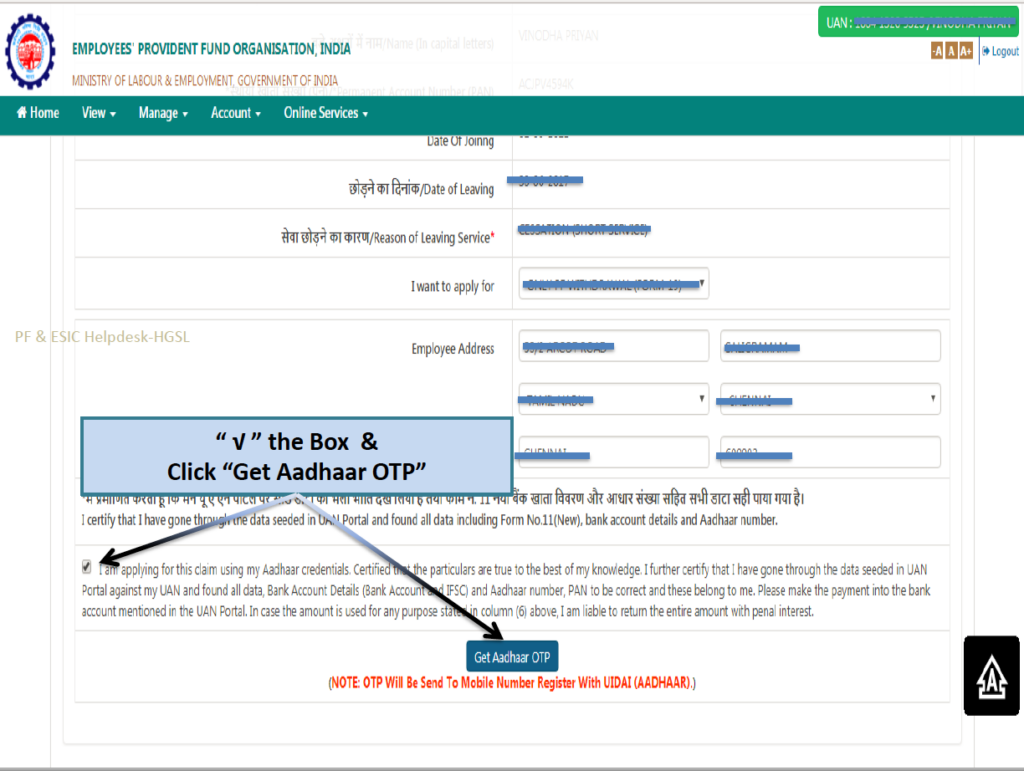

Here we go, the final step: PF withdrawal

Although, you shall be intimidated via email and text message, but I’d say, keep a regular track by checking the status online.

The claim could be either approved or rejected.

If approved, the amount shall be credited in your account with 3 days.

If rejected, the department shall state the reason. There could be many reasons such as KYC not complete or spelling mismatch on portal and document, or joint name in a bank account or employment letter required. After making the corrections or providing more documents they needed, once ready, re-apply.

If there are rejections consistently, even after your necessary corrections as stated in earlier rejection remark, then file a PF grievance. The department will come with a resolution within 3 days after consultation from the respective PF office.

Cover photo courtesy: Getty Images

EPFO portal screenshots courtesy: HGS

4 replies on “Understanding PF withdrawal”

Hi, I need to withdraw my PF but don’t have required details as left the company with dispute. How can I claim it?

Hi Manjunath, you can follow the procedure in my post. First, get your ID proofs and bank details verified by your employer. Second, if you haven’t withdrawn any amount before, then transfer the amount to your last company account (if you have changed more than one company), else proceed with the PF withdrawal (if you have been with one company). Do settle your dispute with your company because it will be their approval after all.

Nice work!! Huzefa

Thank you very much, Robin!