I had been an avid user of Paytm’s digital wallet for settling payments for Uber or Zomato or even friends and colleagues. I switched to Google Pay from the time it entered Indian market. The advantage of Google Pay is that it does not have any payment limitations and directly routes to a bank account. It needs a Google ID and mobile number. It is an instant mobile payment delivery service. It is not a wallet. It is merely a mobile payment facilitator.

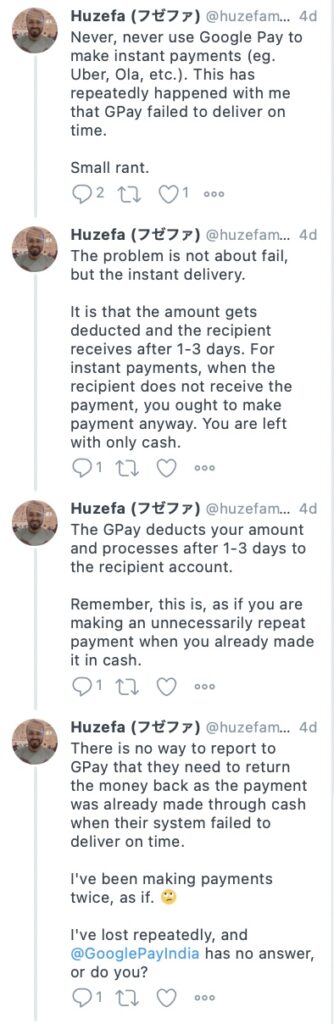

Google Pay could be a mobile payment service provider, but not instant. Let me explain why I think Google Pay is not instant.

I use Uber frequently, subject to as long as it is available. I keep refilling the wallet with gift cards to settle their payments because it is very convenient, and there is no need to carry cash or authorise card (in case of debit/credit cards) payment after each trip or settle via GPay. Imagine, the prompt to first settle payment (if the card option is checked) of an earlier trip made only after a new trip is initiated is a big turn-off. Therefore, gift cards come handy.

Coming back to the subject.

Late last September I was on a work tour to Delhi. As my colleague and I were returning back to the hotel, we were looking for the obvious Uber for the drop off. Being an evening time, the price had surged. Despite the surge, we decided to go further and hail one. Unfortunately, we couldn’t reserve a booking as then there were limited to no cabs available.

Seeing we are helpless, a kind customer tried to book an Ola (I don’t have an Ola app), and luckily he could reserve a spot for us. This was a cash trip of INR 773 (surge). After reaching destination, the price shot to INR 881, possibly due to unexpected traffic or the driver taking an alternate route. Fair enough!

I made the payment via GPay. The amount got deducted immediately from my account but did not reflect in the receiver’s (driver’s) account. The driver insisted that I pay him cash to which I obliged. I assumed that the amount couldn’t get through and shall reflect back in my account. In other words, as per my past experience, I gave Google Pay the benefit of doubt.

There have been even couple of instances where amount got deducted and reflected in receiver’s account after 5-7 days. That means there are two probabilities. During the week, I was in correspondence with GPay customer support who would express that they do not have any control on such transactions and it is up to the bank to process. The bank is not able to help much either as the process is automated.

And then after 7 days, Google Pay sent me a message (within the app) that the amount has been credited in receiver’s account.

The problem is that either the payment will be returned to the sender or will credit the receiver. Both the parties remain in a fix until that time.

The Google Support mentions, “Wait for 3 business days, within which the bank should add the money to the recipient account or reverse the same to your account. If money is not added within 3 business days, please reach out to us.”

It is next to impossible to know if your payment that got deducted but could not instantly credit in the receiver’s account, whether would come back to you or it would credit in the receiver’s account. I may think twice next time if I’ve to make payments to an ‘unknown person’ using Gpay.

Gpay (in collaboration with the bank) should have a system in place to inform either party of their transaction resolution along with time period instantly. That serves as an assurance from the brand.

Image courtesy: Capgemini